tax per mile rate

Taxpayers may use the optional standard mileage rates to calculate the deductible costs of operating an automobile for business and certain other purposes. The business mileage rate for 2022 is 585 cents per mile.

New Mileage Deduction Rates For 2022 Legal Tax Defense

Effective for miles traveled on or after July 1 2022 the standard mileage rate for purposes of deductible business expenses is 625 cents per mile an increase of 4 cents from.

. 2021 rate cents per mile 2020 rate cents per mileBusiness 56 575Medical or Moving16 17Charitable pu. For the final 6. Approved mileage rates from tax year 2011 to 2012 to present date Passenger payments cars and vans 5p per passenger per business mile for carrying fellow employees in a car or van on.

Flatbed truck rates per mile At the time of writing the national average flatbed truck rates are 314 per mile. 56 cents per mile driven for business use down 15 cents from the rate for 2020 16 cents per mile driven for medical or moving purposes for qualified active duty members. Meanwhile the IRS had increased from 585 to 625 cents per mile the mileage reimbursement rate used for certain tax purposes effective in July.

Pennsylvania which has the highest fuel tax in the nation at 587 cents per gallon recently began discussions on whether or not an 81-cent-per-mile tax was appropriatethis. 45p per mile is the tax-free approved mileage allowance for the first 10000 miles in the financial year its 25p per mile thereafter. RATES EFFECTIVE JANUARY 1 2022.

Beginning on January 1 2020 the standard mileage rates for the use of a car also vans pickups or panel trucks will be. 72 cents per kilometre for 202021 and 202122. Rates per business mile Example Your employee travels 12000 business miles in their car - the approved amount for the year would be 5000 10000 x 45p plus 2000 x 25p.

66 cents per kilometre for. 68 cents per kilometre for 201819 and 201920. Car Allowance and Mileage.

The standard mileage rates were 575 cents for business automobiles. You may use this rate to reimburse an employee for business use of a personal vehicle and under certain. 78 cents per kilometre for 202223.

575 cents per mile driven for business use down one. For the 2022 tax year the standard milage rate is 585 cents per mile driven for business use up 25 cents from the rate in 2021. Deducting 4 more in 2022 Q1 Q2 than in 2021 56 cents to 585 and then further increasing that in 2022 Q3 Q4 by 64 585 cents to 625 cents means that youll be.

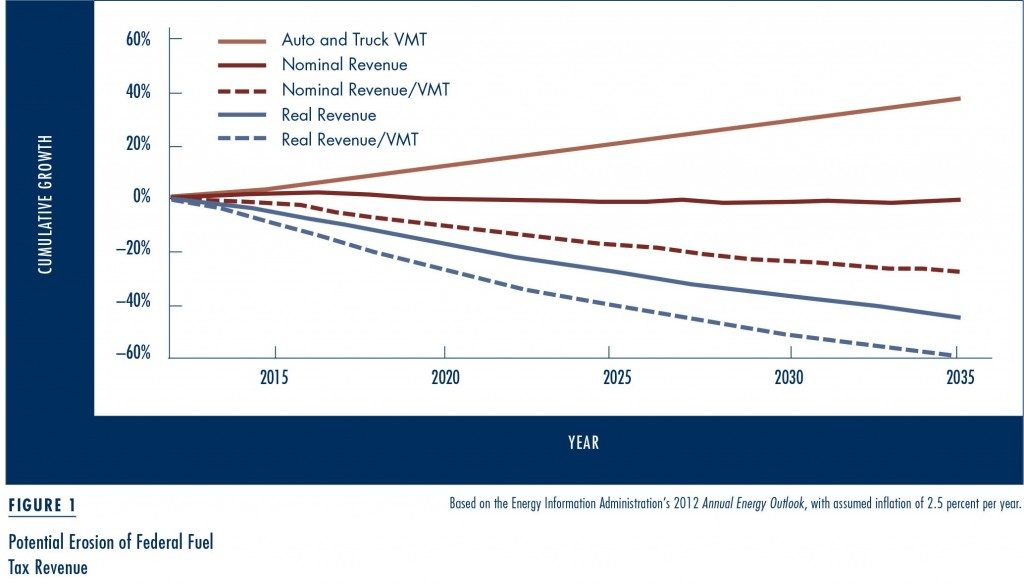

As for Q1 Q2 of 2022 this rate is 585 cents per mile you drive while between July 1 and December 31 2022 the federal business mileage rate is 625 cents per mile the same as the. A federal VMT tax rate must average 17 cents per mile to cover the highway funds expenditures. Cars used by employees for business use the portion of the standard mileage rate treated as depreciation will be 26 cents per mile for 2022.

Use these rates only when operating at declared weights of 80000 pounds or. 18 cents per mile driven for medical or moving purposes for qualified active-duty members of the Armed Forces up 2 cents from the rate for 2021 and 14 cents per mile driven. 1 Understanding the Standard Mileage Rate.

The actual rate per vehicle should be differentiated based on weight per. 15 rows Standard Mileage Rates The following table summarizes the optional standard mileage rates for employees self-employed individuals or other taxpayers to use in computing the. INSTRUCTIONS FOR TABLE A.

In 2020 the IRS issued standard mileage rates per mile for various categories under Notice 2020-05. If a business chooses to pay employees an. However this is just a national average which means your area may have.

The standard mileage rates are.

From Fuel Taxes To Mileage Fees Access Magazine

Tax Reform Brings New Urgency To Mileage Reimbursement

2019 Mileage Rate Increase Hm Taxes

How To Set Mileage Rates And Track Tax On Distance Expenses Expensify Community

Irs Increases Mileage Rate For Remainder Of 2022 Internal Revenue Service

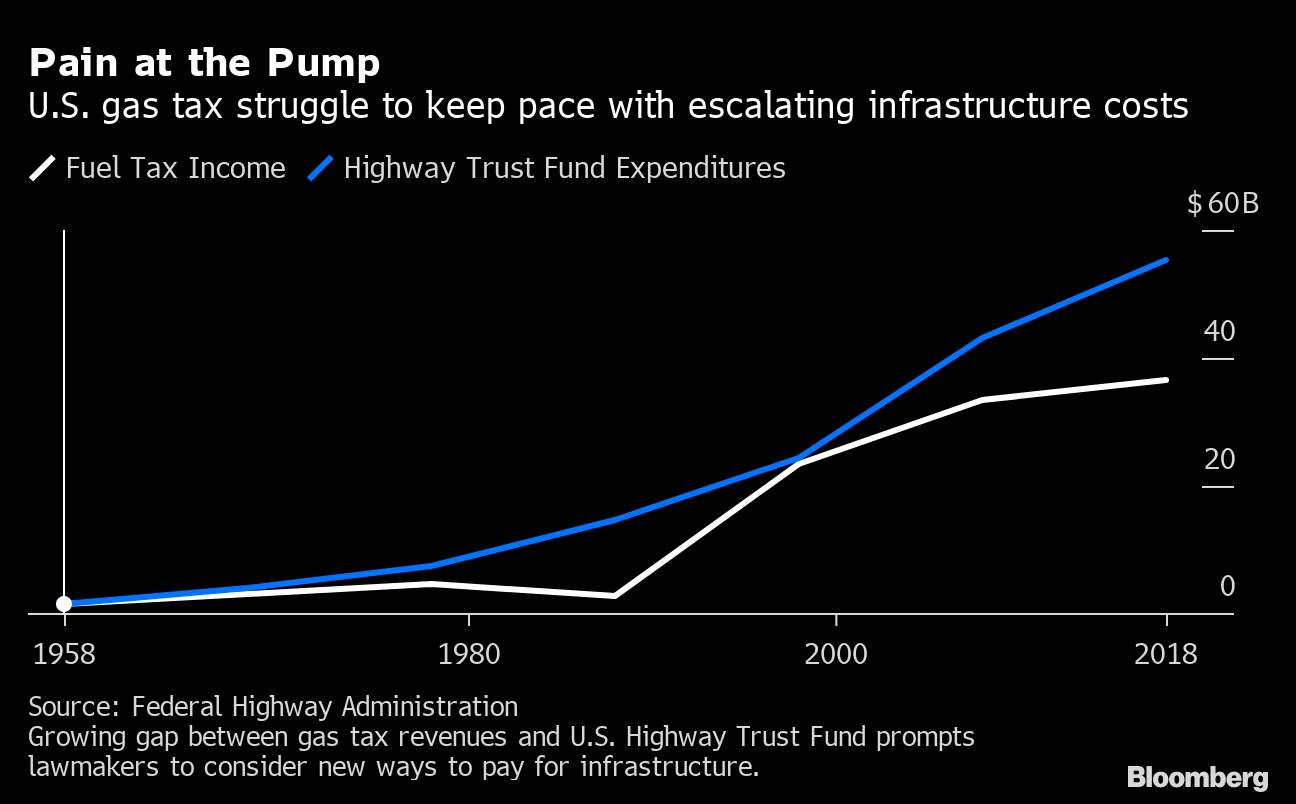

By The Mile Tax On Driving Gains Steam As Way To Fund U S Roads Bloomberg

Impact Of Mileage Rates And Gas Prices On Tax Deductions Pierce Firm Pllc

How To Calculate Personal Use Of Employer Vehicle Rkl Llp

Irs Boosts Mileage Rate Deductions As Gas Prices Soar To 5 A Gallon

By The Mile Tax On Driving Gains Steam As Way To Fund U S Roads Bloomberg

Emerging Tax Regulations Alert Business Mileage Rate Increase

With Gas Prices Spiking This Memorial Day Capitol Hill Awaits Irs Action On Tax Deductible Mileage Rate Requests Don T Mess With Taxes

Mid Year Irs Updates Mileage Rates Tax Return Backlog The 2022 Dirty Dozen

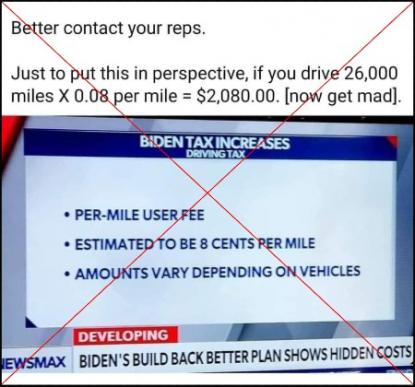

Hidden Road Tax In Us Bill Is Voluntary Pilot Program Fact Check

Irs Raises Standard Mileage Rate For Final Half Of 2022

2020 Standard Mileage Rate Fort Myers Naples Markham Norton

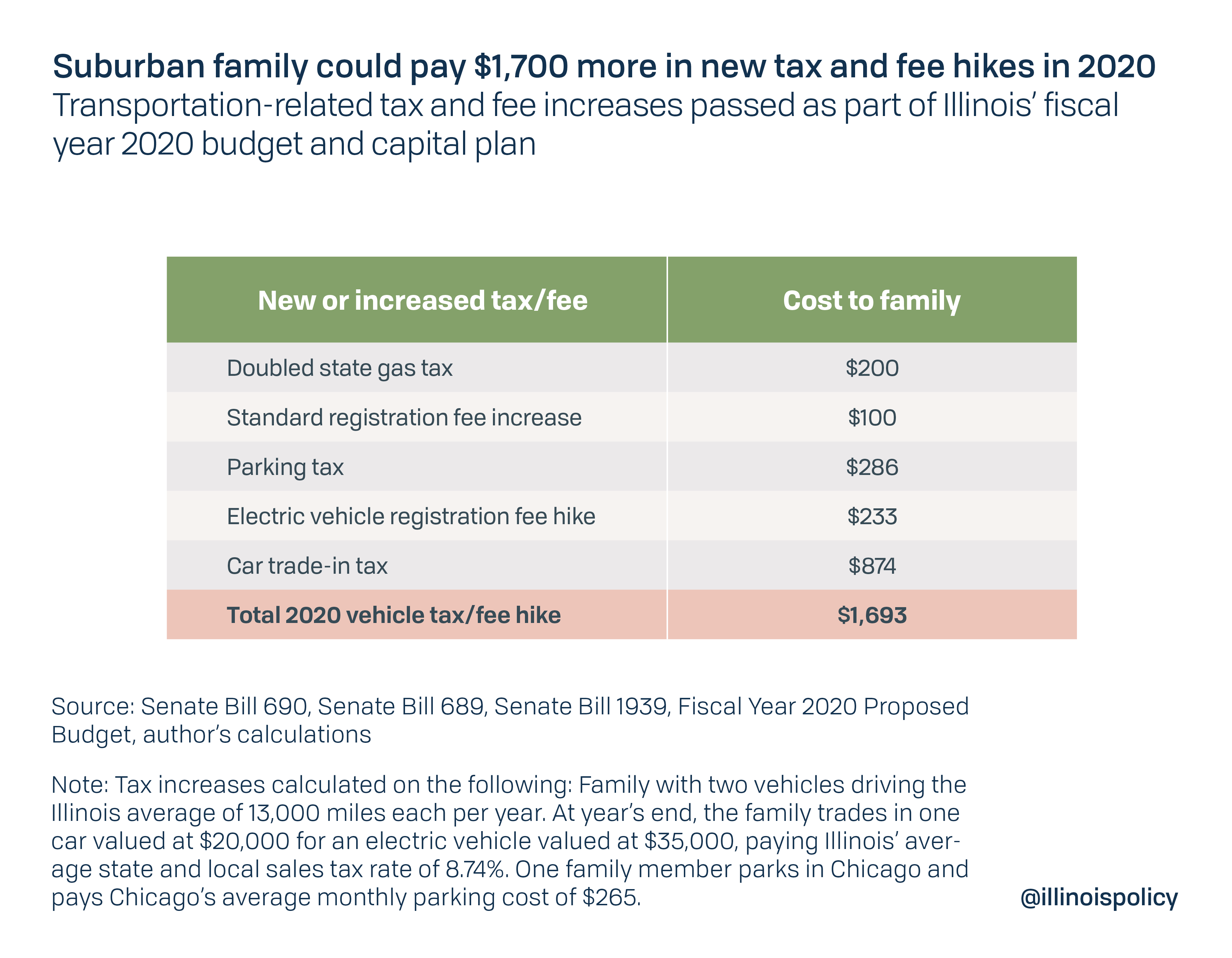

Suburban Families Could Pay 1 700 More In Vehicle Related Taxes Starting Jan 1

Irs Announces Standard Mileage Rates For 2022

2022 Truck Driver Per Diem Pay Advantages And Tax Plan Impacts